Kenya has secured up to 25 billion yen ($169 million) in Samurai financing from Japan to support its struggling automotive and energy sectors, as the East African country continues to diversify funding sources amid rising global borrowing costs.

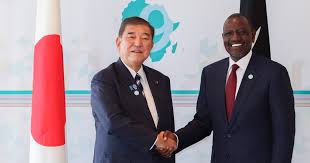

The deal was announced during the ninth Tokyo International Conference on African Development (TICAD 9), attended by senior Kenyan and Japanese officials. It was officially signed by Kenya’s Cabinet Secretary for Foreign Affairs, Musalia Mudavadi, and Nippon Export and Investment Insurance (NEXI) Chief Executive Officer, Atsuo Kuroda.

According to Mudavadi, the financing package is expected to boost Kenya’s local vehicle assembly industry and strengthen parts manufacturing. It will also help address weaknesses in the energy sector, particularly electricity transmission and distribution losses, which currently account for about 23% of the country’s national output. “This facility will strengthen our local vehicle assembly and parts manufacturing industry while also addressing electricity transmission and distribution losses,” Mudavadi said in a post on X (formerly Twitter).

The Samurai loan deal is part of Japan’s ongoing engagement with African nations under TICAD, a framework launched in 1993 to deepen economic ties, trade and development partnerships between Tokyo and African governments. Japan has positioned Samurai bonds and similar credit instruments as alternatives for African countries seeking concessional and market-based financing outside traditional Western sources.

Kenya, East Africa’s biggest economy, is increasingly seeking new funding models to deal with mounting external debt and volatile markets. The country spends about $1 billion annually servicing obligations to China, its largest bilateral creditor. As part of its strategy, Nairobi is negotiating with Beijing to convert part of its dollar-denominated loans into yuan and extend repayment terms, a move officials say could ease borrowing costs and free up fiscal space.

Raphael Otieno, Director-General of Debt Management at Kenya’s National Treasury, explained on the sidelines of TICAD that Kenya is now focused on reducing refinancing risks and lowering the cost of debt. He said the government is considering a mix of sustainability-linked bonds with guarantees, yen-denominated Samurai bonds, renminbi-denominated Panda bonds, and debt-for-development swaps. Kenya has also prepaid some domestic bonds this year, with plans to expand such operations.

Analysts believe the Samurai loan deal could help Nairobi reduce its reliance on expensive commercial debt and create room for domestic investments in manufacturing and infrastructure. Switching repayment from the U.S. dollar to China’s yuan, for example, could cut interest costs by nearly half, while extending maturities would give the government more breathing space in managing its fiscal obligations.

The fresh Japanese financing comes at a crucial time for Kenya, as rising U.S. interest rates have made access to global capital markets more expensive. By tapping into yen-denominated Samurai bonds and deepening ties with Japan, Nairobi hopes to secure more affordable long-term funding while also boosting investor confidence.

For Tokyo, the move reinforces its position as a key development partner in Africa, competing with China’s dominant lending presence while promoting Japanese industrial expertise. In particular, Japan has shown strong interest in supporting African countries’ automotive industries, renewable energy expansion, and resilient infrastructure development.

Launched three decades ago, TICAD has become a major platform for cooperation between Japan and Africa. The Nairobi Samurai loan deal is seen as another example of how African economies are diversifying partnerships to weather global financial turbulence while building strategic industries.