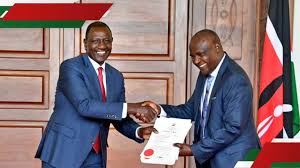

The government of Kenya has unveiled its budget for the 2025/2026 financial year, with a total value of KSh 4.29 trillion, which is about $32.8 billion. This marks the first national budget to be presented under the cooperation between President William Ruto and opposition leader Raila Odinga, following their recent handshake-style understanding. The budget was officially presented by Finance Minister John Mbadi, who is leading the country’s economic agenda during a period marked by high public debt, fiscal pressure, and recent civil unrest over taxation.

The new budget is designed to focus on two key objectives — growing domestic revenue and managing debt — while avoiding the introduction of new taxes. This comes after a difficult year in which the government faced heavy criticism for introducing aggressive tax measures in the 2024 budget. Those measures led to widespread protests across the country, with several people reportedly losing their lives and many others injured during clashes with security forces.

According to the Treasury, the government is targeting a revenue collection of KSh 2.7 trillion, which represents about 64 per cent of the total budget. The balance is expected to come from other sources including KSh 560 billion from government service charges and KSh 47 billion in grants from international partners. However, even with these plans, there is still a budget shortfall of KSh 876 billion. To bridge this gap, the government plans to borrow KSh 592 billion from the domestic market and KSh 284 billion from foreign sources.

Kenya’s debt burden continues to raise concerns. The current debt-to-GDP ratio stands at 66 per cent, far above the recommended limit of 55 per cent set by international financial institutions. Despite this, the government insists that the borrowing is necessary to support critical infrastructure and service delivery, especially in areas where funding gaps remain wide.

In terms of sector allocations, education received the largest share of the budget, with KSh 701.1 billion set aside. This is followed by the energy, infrastructure and ICT sectors, which collectively received KSh 500.7 billion. Security agencies are expected to receive KSh 251 billion, while the health sector will get KSh 136.8 billion. This includes KSh 54 billion for referral hospitals and KSh 16.6 billion for disease prevention and control. The agriculture sector has been allocated KSh 78 billion, out of which KSh 8.2 billion is earmarked for fertilizer subsidies to support smallholder farmers.

The budget also shows support for Micro, Small and Medium Enterprises (MSMEs), which will receive more than KSh 12 billion. County governments across the country are set to share KSh 405.1 billion to fund local projects and salaries. In housing, the government plans to deliver 215,000 affordable homes and build 94,000 hostel beds to address accommodation challenges. Another KSh 3.7 billion will go into expanding the digital economy through fibre optic connectivity and public Wi-Fi access.

This budget is closely tied to President Ruto’s Bottom-Up Economic Transformation Agenda, known as BETA. It also supports Kenya’s long-term development strategy, Vision 2030. Minister Mbadi said the government will focus on widening the tax base, improving tax compliance, and cutting unnecessary spending to prevent future social unrest. However, experts warn that the high level of borrowing and ambitious revenue goals may make implementation difficult. There are fears that the government may be forced to introduce supplementary budgets during the year, which could further weaken public confidence.

In 2024, the government faced strong opposition from civil society groups and ordinary Kenyans after introducing new taxes on essential goods and services. This led to street demonstrations in major cities such as Nairobi, Kisumu, and Mombasa. To avoid a repeat of those events, the new budget contains no new tax measures. Instead, it proposes stronger enforcement of existing tax laws and better management of government spending.

Minister Mbadi told lawmakers that the government is working to manage its debt responsibly. He added that economic reforms are ongoing and the government is seeking to create a more efficient public finance system. However, with a high debt profile and rising public expectations, the government may face more pressure in the months ahead.

The budget has now been tabled in the National Assembly for debate and approval. If passed, it will take effect from July 1, 2025.