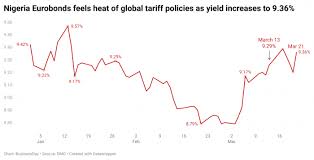

The yields on Nigerian Eurobonds experienced an uptick last week as foreign investors adjusted their portfolios in response to the U.S. Federal Reserve’s decision to maintain its current interest rates. This move by the Fed has influenced investment flows, leading to a sell-off in Nigeria’s Eurobond market.

The stability in U.S. interest rates often makes American assets more attractive to investors seeking safer returns, prompting a reallocation of funds from emerging markets like Nigeria. This shift has resulted in increased yields on Nigerian Eurobonds, reflecting a decrease in their prices as demand wanes.

Analysts observe that the unchanged U.S. rates have heightened caution among foreign investors regarding emerging market assets. The relative appeal of U.S. securities, coupled with prevailing global economic uncertainties, has contributed to the sell-off in Nigeria’s Eurobond segment.

The rise in Eurobond yields could lead to higher borrowing costs for Nigeria on the international stage. This development may pose challenges for the nation’s fiscal plans, especially in managing debt obligations and financing developmental projects.

Market watchers suggest that Nigeria’s economic policymakers should monitor these international financial trends closely. Implementing strategies to bolster investor confidence and diversify the economy could mitigate the adverse effects of such global financial shifts.