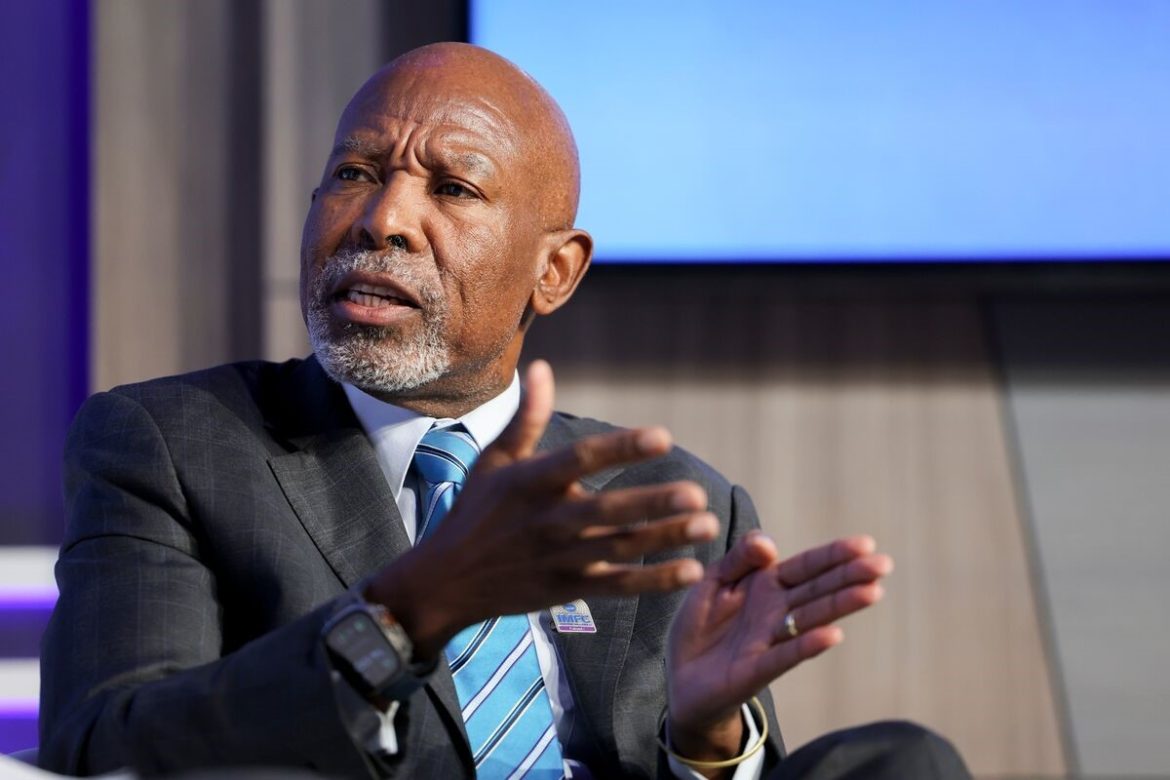

South Africa may achieve its revised 3 per cent inflation target by 2026, as price pressures remain largely contained, Governor of the South African Reserve Bank (SARB), Mr Lesetja Kganyago, has said.

Speaking on Tuesday, Kganyago noted that inflation dynamics are evolving in line with the central bank’s projections, putting the country on track to meet the new target earlier than previously anticipated.

Annual inflation for 2025, due for release on Wednesday, is expected to come in between 3.2 per cent and 3.4 per cent, according to estimates cited by Reuters.

Recall that the South African government and the SARB last year lowered the inflation target to 3 per cent, with a tolerance band of plus or minus one percentage point, marking the first adjustment to the framework in 25 years. At the time, authorities projected the target would only be achieved by 2027.

“We expect that inflation this year would average about 3.6 per cent. When you break it across the different categories, they all have a three-handle, which suggests we are firmly on course to meet the new inflation target by 2026,” Kganyago said.

The SARB’s benchmark lending rate currently stands at 6.75 per cent. According to the governor, the bank’s projection model indicates scope for as many as two additional 25 basis point interest rate cuts this year. The Monetary Policy Committee (MPC) is scheduled to hold its first meeting next week.

Rand gains momentum

Meanwhile, the South African rand has recorded its strongest weekly rally in over two decades, buoyed by rising precious metal prices and signs of gradual improvement in the country’s economic outlook.

Investor sentiment has also been supported by the central bank’s cautious policy stance and renewed government efforts to stimulate growth in Africa’s most industrialised economy, which has expanded at an average rate of less than one per cent over the past decade.

Analysts say last year’s adoption of a lower inflation target has strengthened expectations that South Africa will retain a favourable interest rate differential over the United States.

According to Bloomberg Economics, upcoming inflation data could further confirm that price pressures have peaked.

With inflation projected around 3.6 per cent and the policy rate at 6.75 per cent, South Africa’s real interest rate remains above 3 per cent, reinforcing the rand’s appeal to yield-seeking investors.