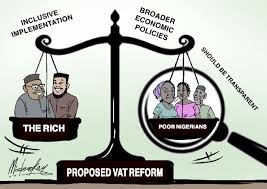

The Federal Government has introduced a major plan to change the Value-Added Tax (VAT) system in Nigeria. This new reform is aimed at giving states more control over VAT revenue and making life easier for Nigerian families. The planned VAT law changes are expected to increase the rate, exempt more essential items, and change how VAT income is shared between government tiers.

According to the Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, Mr Taiwo Oyedele, the VAT rate will move from the current 7.5 percent to 12.5 percent by 2026. However, he explained that the increase will not affect most everyday items that Nigerians depend on. Items such as food, medicine, school fees, transport fares, hospital services, electricity, cooking gas, and house rent will all be exempted. These goods and services represent about 82 percent of what most Nigerians spend money on.

Oyedele noted that although people may be worried about the new VAT rate, they should understand that many of the things they buy will not be taxed. He said, “This is a fair reform. Nigerians will actually spend less on VAT because the things that matter most will now be tax-free.”

The reforms also favour businesses. Companies can now claim full VAT credits on plant and equipment they purchase. In addition, the threshold for VAT registration will increase from ₦25 million to ₦50 million in yearly turnover. This means that many small businesses will be free from the stress of VAT registration and payment, which will also help reduce compliance costs.

One of the biggest changes in the new law is the way VAT revenue will be shared. Before now, VAT was distributed mostly based on where companies have their head offices, which gave an advantage to some northern states. But under the new arrangement, 55 percent of VAT will go to the state where the product or service is used (the consuming state), 35 percent will go to local governments, and the remaining 10 percent will be kept by the Federal Government. This system will favour states with more consumer activity, like Lagos, Rivers, Ogun, and others in the South.

This change has caused serious debate across the country. Governors and lawmakers from the northern part of Nigeria have kicked against the new plan. They fear that it will reduce how much their states receive from VAT, which may increase poverty and economic imbalance between the regions. On the other hand, groups like the Development Agenda for Western Nigeria (DAWN) Commission say the new formula is fair and reflects where the economy is really active.

In response to the concerns, the House of Representatives has already adjusted the bills. The lawmakers agreed to maintain the VAT rate at 7.5 percent for now, limit the revenue derivation by states to 30 percent, and exempt people earning minimum wage from income tax. The bills are currently awaiting Senate approval and the final assent of President Bola Tinubu.

The VAT reform is just part of a larger tax reform package. Other parts include merging multiple tax laws into one simple Act, introducing a global minimum tax for multinational companies, reducing corporate income tax from 30 to 25 percent, and setting up an independent Tax Ombudsman to protect the rights of taxpayers. There are also plans for faster tax refunds.

Supporters of the reform believe it will make the tax system more balanced and fair. They say it will reduce the pressure on low-income earners, encourage more businesses to come into the formal sector, and promote economic growth. They also say the changes will help Nigeria raise more tax without borrowing too much.

However, some critics have warned that increasing VAT, even with exemptions, could still cause inflation and reduce consumer spending if not well managed. They are calling for better communication from government to explain the full details to citizens.

If the reforms are passed and well implemented, they could help improve Nigeria’s tax-to-GDP ratio, which is currently one of the lowest in Africa at around 10.8 percent. It will also help build stronger state economies and reduce reliance on oil revenue.

As the Senate debates the proposal, the country is watching closely. The outcome will test how Nigeria balances fairness, growth, and regional equity in its tax system.