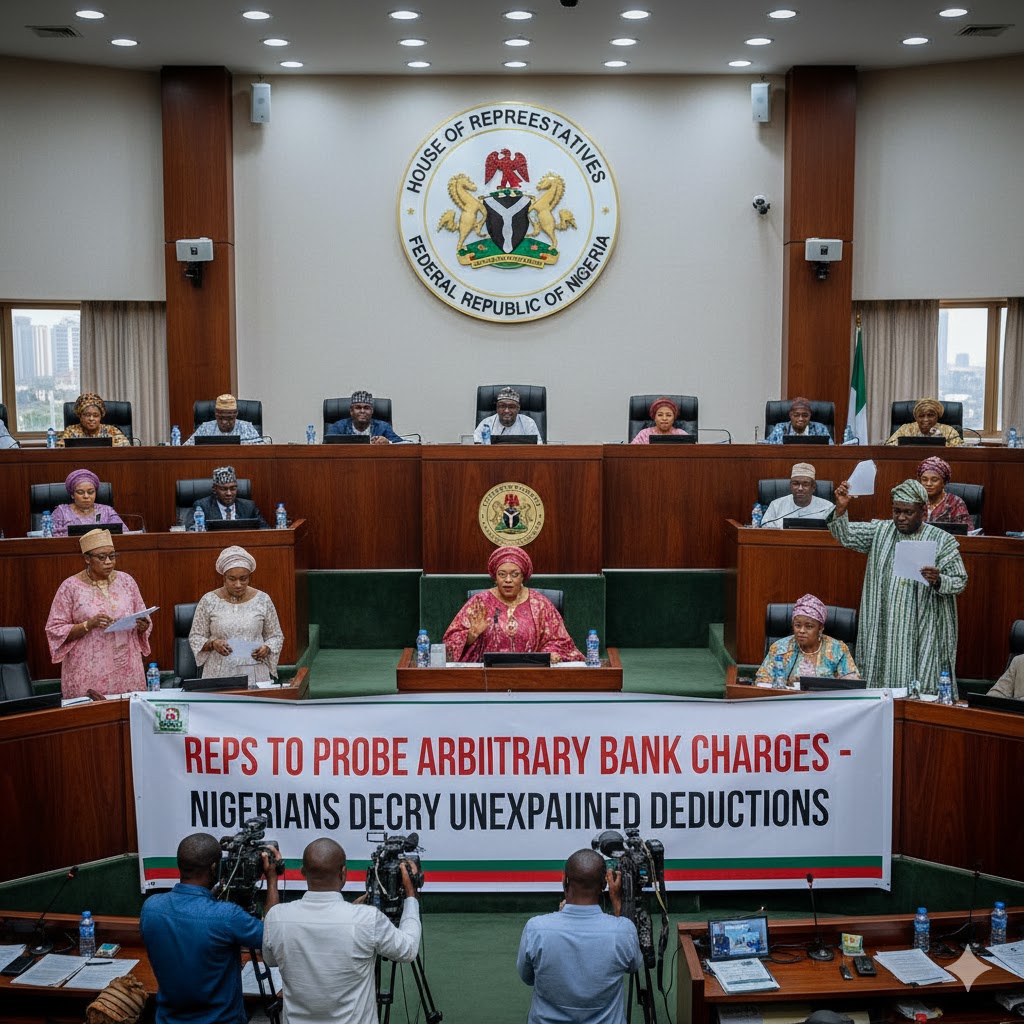

The House of Representatives has resolved to investigate what it described as the arbitrary, excessive, and unexplained charges imposed on customers by commercial banks across Nigeria. The lawmakers made this decision during Tuesday’s plenary session following a motion of urgent public importance sponsored by Honourable Tolani Shagaya, representing Asa/Ilorin West Federal Constituency of Kwara State.

The motion, titled “Need to Curb Arbitrary Bank Charges and Protect Nigerian Customers,” was adopted at a sitting presided over by the Speaker of the House, Tajudeen Abbas. Shagaya drew attention to the growing concerns among Nigerians over what he called “incessant and unjustified deductions” from bank accounts, despite repeated warnings and guidelines from the Central Bank of Nigeria (CBN).

Hon. Shagaya noted that many deposit money banks in the country continue to impose a variety of charges without clear explanations to customers, in violation of CBN’s approved fee structure. He warned that such practices could weaken public trust in the banking system and discourage citizens from saving, thereby undermining the apex bank’s financial inclusion campaign.

“These incessant charges have become not only a source of frustration but also a barrier to financial inclusion,” Shagaya said. “When citizens lose confidence in the banking system, it defeats the government’s efforts to build a robust digital and cashless economy.”

The House resolution marks the latest in a series of efforts by lawmakers to address concerns about excessive banking fees. In 2016, the House had raised alarm over shady dealings by some commercial banks after a motion by Mr. Tajudeen Yusuf, the then member representing Kabba/Bunu/Ijumu Federal Constituency in Kogi State. At the time, Yusuf accused banks of abusing the N65 Automated Teller Machine (ATM) withdrawal charge, which was meant to apply only after the third withdrawal from another bank’s ATM.

Similarly, in 2023, the House expressed anger over what it termed “excess charges and illegal deductions” by banks, following a motion moved by Honourable Godwin Offiono. Offiono alleged that many banks were “fleecing customers through unauthorised deductions” in violation of existing financial regulations.

He listed some of the recurring questionable charges to include excessive SMS alert fees, card maintenance charges, account maintenance deductions, and interbank transfer costs, among others. Offiono stressed that these deductions had become a source of financial strain for ordinary Nigerians already battling with economic hardship.

During Tuesday’s debate, lawmakers across party lines supported Shagaya’s motion, stressing the need for urgent intervention to protect depositors. The House therefore called on the Central Bank of Nigeria to immediately publish a simplified and comprehensive list of all approved bank charges to promote transparency and consumer awareness.

The lawmakers also urged the CBN to strictly enforce compliance with its regulations and impose sanctions on erring banks that continue to exploit customers. They further mandated the apex bank to set up an efficient and accessible complaint resolution system where customers can lodge grievances about arbitrary deductions and receive timely feedback.

The House also extended its directive to the Federal Competition and Consumer Protection Commission (FCCPC) and other relevant agencies, urging them to launch a nationwide awareness campaign to educate Nigerians on their consumer rights and the proper channels for seeking redress against financial exploitation.

As part of the resolution, the House Committee on Banking Regulations was mandated to summon representatives of the CBN and major commercial banks to appear before it and explain the recurring cases of unauthorised deductions from customers’ accounts. The committee is also expected to monitor compliance with existing banking guidelines and recommend appropriate legislative or regulatory measures to strengthen consumer protection in the financial sector.

Reacting to the development, a banking sector analyst, Mr. Tunde Olagunju, commended the lawmakers for addressing what he called “a long-standing source of public frustration.” He noted that while banks are expected to cover operational costs, transparency must be prioritised to sustain public confidence. “Nigerians have a right to know what they are being charged for and why,” Olagunju said. “Unexplained deductions only worsen the trust gap between banks and their customers.”

Many Nigerians have expressed similar concerns, particularly on social media, where complaints about bank charges continue to trend. Some customers allege that banks apply multiple deductions for SMS alerts, maintenance fees, and transaction costs without providing detailed breakdowns.

With the House resolution, Nigerians are hopeful that the new investigation will finally lead to stricter oversight and fairer treatment of customers. The lawmakers said they remain committed to ensuring transparency, accountability, and consumer protection within the nation’s financial system.