.High prices push govt homes beyond average Nigerians’ reach

Despite the overwhelming gap in housing provision in the country, the Federal Government’s 2,870 houses in different states are beyond the reach of low-income earners.

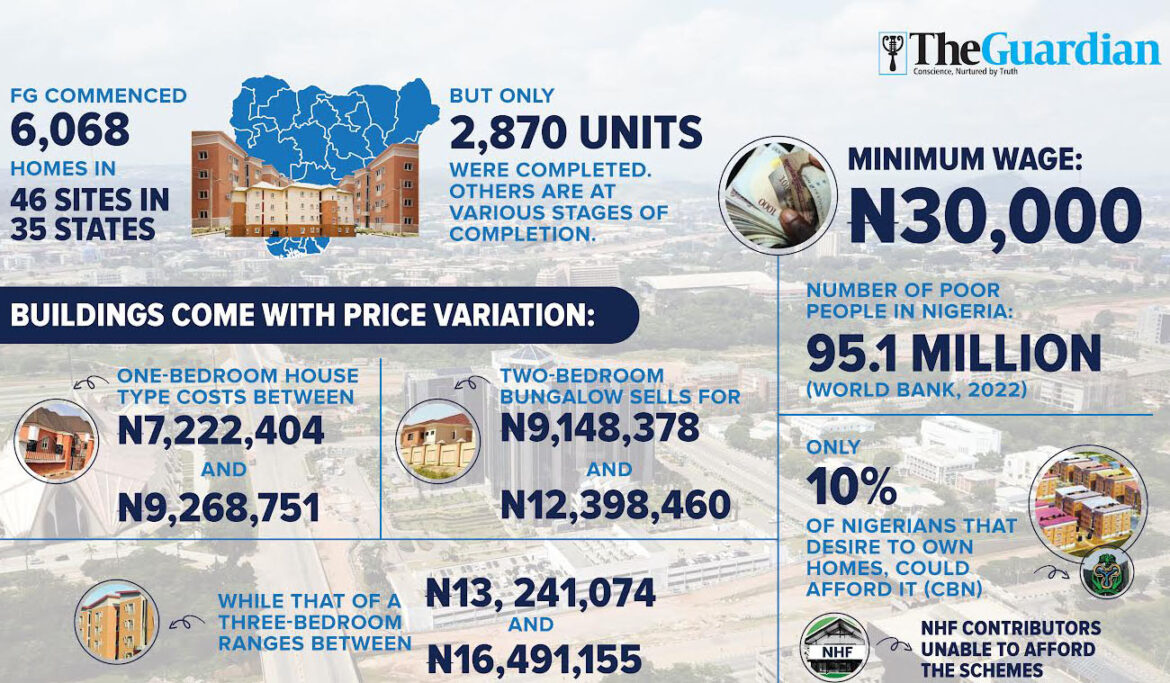

The houses were constructed by the President Muhammadu Buhari administration through the former minister, Babatunde Fashola, under the National Housing Programme (NHP). The government commenced 6,068 homes in 46 sites in 35 states, while 2,870 units were completed; others are at various stages of completion.

Among the NHP projects are 83 units of two and three-bedroom bungalows completed in Makurdi, Benue State, of which N712m was expended out of the N768m set aside for the project.

Others are 80 units of various house types and associated infrastructure in Yenagoa, where N342 million was spent out of the budgeted N2.28bn; while 86 units of two and three-bedroom bungalow house types and associated infrastructure in Cross Rivers State that N570.35m was released out of N830.12 million.

Also, in Anambra State, work is ongoing on the construction of 104 units of various house types with associated infrastructure and scheme, which received N246.74m out of N1.8bn.

It is the same story on NHP projects in Rigachikun, Kaduna State; Gama-Gwari, Fagge Kano State; Akinyele Area of Oyo State; Uyo, Akwa-Ibom, State; Minna, Niger State; Avu Town, Along Port Harcourt Road, Owerri, Imo State; Jalingo, Taraba State and every other state, where the project is ongoing.

Nigeria has been in a severe housing crisis, especially in the major cities, as the average house costs more than the minimum wage, vacancy rates are below five per cent and rental accommodation has dropped considerably.

The long-standing housing crisis has been worsened by reduction in new constructions, which prompted inflated property prices and soaring rents. The combination of a growing urban population, lack of an efficient mortgage system, poverty, increasing construction costs, high inflation and declining household income, have also made access to decent and affordable housing difficult for many Nigerians.

Rural-urban migration has also contributed to the shortfall of housing in urban centers. The unresolved tenure arrangements, access to infrastructure, deficiency of housing finance arrangements, encumbrances in the process of legal documents and inadequate government housing policies are also major issues affecting housing delivery.

Several efforts to address the housing situation by successive governments in Nigeria have yielded limited success over the years. Today, the nation is estimated to have a housing deficit of between 20 to 22 million homes that are missing from the national housing market, though the current demand is estimated to be above that figure.

Nigeria’s housing deficit would take at least a half of a century to fill even if the Federal Government’s current target to build one million homes a year is reached.

The implications of high housing deficit are that tenants in rented apartments pay as high as 60 per cent of their average disposable income, far higher than the 20-30 per cent, recommended by the United Nations.

Currently, the total current housing production is at about 60,000 units per year, which is grossly inadequate for a country of nearly 200 million people. It is estimated that it will cost $363 billion to curb the current housing deficit and the number is expected to keep growing, while a World Bank study projects that the cost of bridging this 20 million housing deficit is N59.5 trillion.

The housing sector has traditionally played a central role in the economy of nations and is the bedrock of the economy in more advanced economies like the United States of America, Great Britain and Canada, where the sector contributes between 30 per cent and 70 per cent of the Gross Domestic Product (GDP).

The sector’s GDP contribution rose to N8.9tn despite high-interest rates, inflation, and cost of building materials, among other challenges faced last year. The yearly growth rate of the real estate sector was 10.75 per cent in 2022 with a total contribution of 5.64 per cent, higher than the 5.60 per cent reported in 2021.

Specifically, one of the setbacks for the NHP scheme is the introduction of costly housing prices, which private developers said is not affordable and justifiable as it is beyond the low-income earners and may breed corruption among civil servants.

Under the scheme, buildings come with variation in prices as a result of the cost of building and topography. The units range from one, two to three-bedroom bungalows and blocks of flats across 34 states and the Federal Capital Territory.

For instance, the one-bedroom house type costs between N7,222,404 and N9,268,751; two-bedroom bungalow sells for N9,148,378 and N12, 398,460, while that of a three-bedroom range between N13, 241,074 and 16,491,155.

Currently, the mortgage system remains a treacherous path for prospective homeowners. There are concerns by contributors to the National Housing Fund (NHF) on the impact of the scheme in providing leeway for home ownership, especially for low-income earners.

The government has promoted mortgage support schemes to would-be beneficiaries, but unfortunately most of the NHF contributors could not afford the schemes.

Notwithstanding the reduction of equity contribution from five per cent to zero per cent for those seeking mortgage loans of up to N5 million, and reduction from 15 per cent to 10 per cent for those seeking loans over N5 million, not many employees could have access to housing.

According to the World Bank, the number of poor people in Nigeria reached 95.1 million by the end of 2022. The Central Bank of Nigeria (CBN) also noted that only 10 per cent of Nigerians, who desire to own homes, could afford it. When compared to China 60 per cent, 72 per cent in the United States, 78 per cent in the United Kingdom and Singapore 92 per cent, the estimate is largely inadequate for the size of the economy.

“Apart from FMBN, there is no other source of long-term mortgages. Today, interest rates are about 23 per cent in the banking sector. Accessing the NHF, which gives funds at about six per cent, is a tedious process and the loan available from it has a cap of about N15 million,” according to Mr. Emeka Eleh, past president, Nigerian Institution of Estate Surveyors and Valuers (NIESV).

For the other experts and developers, the Federal Government has always performed poorly in the provision of houses. Executive Secretary, Association of Housing Corporations of Nigeria (AHCN), Mr. Toye Eniola told The Guardian that the housing sector has witnessed a huge disappointment. “Obviously, there was no commitment to mitigating the rising housing deficit. FHA did not have tangible support to assist them in mass housing.

“Rather than encourage agencies such as FHA or private developers to embark on mass housing, the ministry that was supposed to be a policy maker directly embarked on construction and neglected its role of providing an enabling environment for the thriving of the sector.”

Eniola also explained that the past administrations did not perform well because they lacked direction and commitment. “It was working literally against an established national housing policy that seeks to provide affordable housing for the people, especially in the area of social housing,” he said.

President, Real Estate Developers Association of Nigeria (REDAN), Dr. Aliyu Wamakko, said most of the houses built by the past administration are unaffordable and in obscure locations. He wondered who will pay for the houses and how the ministry plans to recoup money spent on constructing the buildings. “The prices are high, nobody can afford it and the environment is not conducive for families,” he said.

According to him, if the government is serious about housing development, the private sector should be the best to drive it, while the government provides an enabling environment and loans with single digit interest rate.

Minister of Housing and Urban Development, Ahmed Dangiwa, told The Guardian that he is aware of the challenges that the latest version of the NHP faces in terms of selling houses that have been constructed and delivered.

“The prices are beyond the reach of the target market – low to medium income earners, and the locations are inaccessible. This situation has tied up significant government funds, and without swift action, these houses could begin to deteriorate.

“I will prioritise affordability in house design and delivery. In the case of this specific project, we will carefully study and review the factors that led to the current pricing and determine the best approach to make these houses accessible to Nigerians. The goal is to promote affordability, attract potential buyers and ultimately ensure that these housing units benefit Nigerians.”

AHCN wants commitment to policy formulation and enhancements that will attract investment into the sector, which should be driven with an attractive mortgage system with foreclosure that will create a vicious cycle, attract funding and recycle the same for easy recouping of invested funds into the sector.

Eniola said: “State housing corporations should be empowered to carry out their statutory responsibility as facilitator of mass housing provision and usurpation of this noble role by ministries should be discontinued. The ministries should concentrate on providing an enabling environment to housing corporations.

“Housing corporations should focus on mass production of houses both for outright sales and for rental, while the ministry on the other hand should encourage development of the mortgage market, facilitate the development of vibrant housing cooperatives to create systemic off-takers for houses developed by housing corporations and support housing agencies in accessing funding in terms of securing guarantee for development.

The Managing Director, NISH Affordable Housing Limited, Dr. Saheed Adelakun, urged the government to institute a marshal plan for sustainable provision of houses to Nigerians, saying the plan should be aimed at improving living conditions of Nigerians, creating employment and catalysing the economy through the multiplier effect of housing development.

He also said, there should be a demand approach to affordable housing and creation of a revolving intervention fund for financing housing off-takers directly or through their cooperatives at single digit interest rate. The government may also explore housing vouchers and other financial instruments as vehicles to finance off-takers for immediate impact with limited intermediaries and processes.

“In turn and based on the off-takers’ fund, government should facilitate issuance of bankable off-takers guarantees to attract domestic and global construction companies with proprietary technologies and finance for rapid, large scale, cost effective and efficient delivery of affordable housing, while prequalified contractors with proven technological and financial capacity should be made to construct pre-designed houses at negotiated prices in exchange for bankable off-takers guarantees,” Adelakun added.

Source; guardian.ng