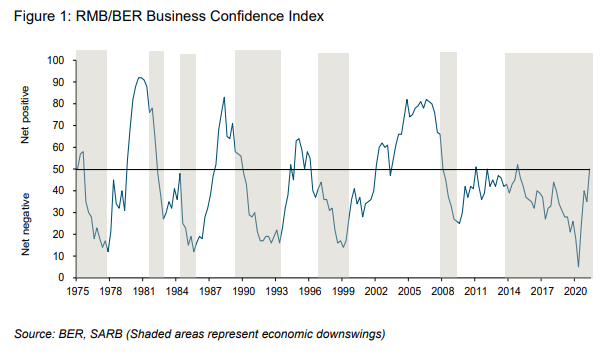

A recent report by the Bureau for Economic Research (BER) states that the RMB/BER Business Confidence Index (BCI) jumped by 15 to 50 in the second quarter of 2021 but declined by 5 points in the first quarter as most South African businesses start to find their footing.

The report further states with the index at exactly 50 points, the number of respondents satisfied with prevailing business conditions now equal those that are unsatisfied.

The Q2 survey was conducted between 12 and 31 May, covering approximately 1,300 business people spread across the building, manufacturing, retail, wholesale and motor trade sectors.

Confidence rebounded sharply in the manufacturing, retail trade and motor trade sectors. By contrast, sentiment among building contractors and the wholesale trade sector improved only marginally.

After crashing by 13 points to 37 in the first quarter, retail confidence bounced back strongly to 54.

High-income earners with savings to spend, and others with an increased appetite for credit, seemingly continue to benefit retailers of durable and semi-durable goods at the expense of those selling food and groceries.

Beginning to weigh on retailers of non-durable goods are recipients who no longer benefit from specific Covid-19 income support measures, the BER said.

Figure1: RMB/BER Business Confidence Index

While the improvement in sentiment is no doubt encouraging, uncertainties remain, the BER said.

Various risks could easily still knock confidence in the period ahead – including, but not limited to:

- The fast-spreading third wave of Covid-19 infections;

- The danger of additional lockdown restrictions being imposed;

- Eskom’s electricity grid that looks increasingly unstable; and

- The looming threat of industrial action.

Notable too is the fact that the rebound in the BCI thus far has mainly been driven by consumer-sensitive sectors, while confidence in sectors linked to the supply-side of the economy remains distinctly lower – a theme yesterday’s this week’s GDP release corroborated.

“In the end, for the current cyclical economic recovery to develop into a durable business cycle upswing, jobs must be created, and for that to happen, fixed investment must accelerate.

“To this end, it would help if the government fast-tracks its infrastructure drive, while simultaneously, and speedily, implements overdue business-friendly reforms,” said Ettienne le Roux, chief economist at RMB.